By: Kody Gustafson

In Banerjee and Duflos Poor Economics they discuss Micro-credits and the effects they can have in poverty-stricken countries. Micro-credits are described as being an extension of small loans to poor borrowers who most likely lack collateral, steady employment, or credit history. One negative aspect of Micro credit institutions is that they often disprove of people borrowing money to buy consumption-based goods. To prevent those using their credit some institutions have made an effort to ensure that the money being spent is strictly income based. On the other hand, these programs are positive because they encourage borrowers to work together and reduces the amount of risk associated with the loan. These micro-credits allow for the poor to avoid the high costs associated with bank withdrawals. These programs can be attractive in part because they are incentive based and the group can cover a member who may not have been able to make his payment. Another positive is that by pooling resources the poor avoid the problem of having a small individual account that is not likely to be allowed by a bank. I believe these programs hold much promise, but they must be restructured to accommodate those who are in need of their services. I believe the plans should consider the circumstances in which agricultural workers live and create payment plans that best suit it.

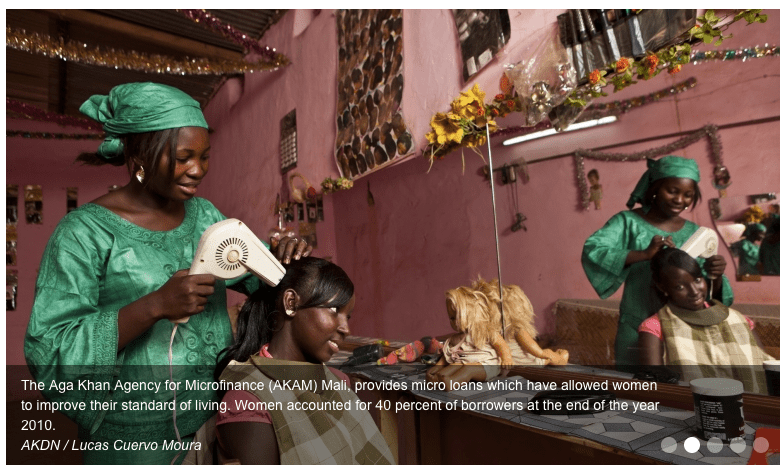

There are currently 126 Micro-Credit institutions established in my country of Mali. However, of those 126 many of them are on the verge of bankruptcy and need support. One significant problem with the implementation of micro finance in Mali is that the political climate is relatively unstable, and threats of violence are common. Government corruption has hindered the progress of reducing the level of poverty in Mali and much of the population has lost support for these micro-credit institutions. However, there still is hope for these institutions and that is in part due to a select few which have diversified between operating in both urban and rural settings as well as beginning to offer both credit and savings products. Another step in the right direction is through the implementation of credit programs that are tailored to the needs of agricultural workers, which includes most of the poor. Combining cheaper and more efficient technology with micro-credit programs could be vital in putting an end to poverty.

The article “Instead of Bringing Jobs” offered a new approach to ending the poverty crisis in Africa and other struggling countries. I found their solution to be a reasonable approach that has protentional to reduce seasonal poverty. By giving seasonally timed loans agricultural workers would be able live with less risk and be able to focus on other aspects of life. Time and time again job creation in some of these countries has failed, however this approach could be the solution to the problem. I believe their approach to ending seasonal poverty is an innovative approach, however it is a program that is limited to certain situations which fit a certain criterion. I am skeptical that this would work in Mali due to security concerns and the geographic nature of the country. Migration to seasonal work could prove difficult due in part to Mali’s lack of adequate infrastructure.

The article by Nick Dearden offers a new perspective on the current economic situation in Africa. I was surprised and troubled after reading about how much money leaves Africa every year and about some of the policies that enable this to happen. I agree that the global community should act much like a state government when it comes to the redistribution of wealth. I believe the international community should take steps to redistribute wealth back to countries which have been exploited over the years. The article goes on to discuss how African governments must stop allowing for large companies and subsidiaries to operate in tax havens which allow for wealth to be concentrated with a few people and allow for it to leave Africa without sufficient returns. The international community must also quit pressuring African governments into opening up their economies to privatization and their markets to competition that is unfair. We must allow and help to an extent these African governments to legally regulate companies and other investments within their country.

I side with economist Jeffery Sachs when it comes to the debate over the pros and cons of development aid. I believe that to truly solve poverty we must establish clear cut aid objectives that we can keep reliable data on. By raising living standards and giving people the ability to voice their opinions, I believe the government will in turn improve in both their transparency and ability to efficiently eradicate poverty. I’ve been doing much research on Mali and one of the leading factors of why poverty persists there is because the government is unable to effectively implement policy. Threats of violence and corruption must be eradicated first before meaningful change can be done. After reading and watching an interview with Jeffery Sachs and Esther Duflo I still believe the most appropriate approach is by first raising living standards through programs that are measurable. We must begin to allocate our resources in a more efficient manner and create new incentives that will promote growth. If funds were used appropriately a lot less could make a much more significant impact.

Mali is currently a country described as being severely off track. One reason it is classified as being so is because poverty rates have seen little decline over the years. This is in part due to the political instability and violence plaguing the nation. Sufficient change has not been made in the right direction and officials in Mali must come up with new strategies to combat poverty. One way they can make change is by expanding the scope of current reform projects in the country and making them nationwide to ensure that all have access.